haven't done my taxes in 3 years canada

Ad Need help with Back Taxes. There could be many reasons why a person wouldnt have paid their taxes for several years.

Tax Tip Do I Have To File Taxes In Canada Every Year 2022 Turbotax Canada Tips

No matter how long its been get started.

. Start with a free consultation. Start with a free consultation. Not filing a tax return on time is one of the most common tax problems.

You could owe a lot of money and not be able to afford to repay it you might have forgotten to pay. These Tax Relief Companies Can Help. We work with you and the IRS to resolve issues.

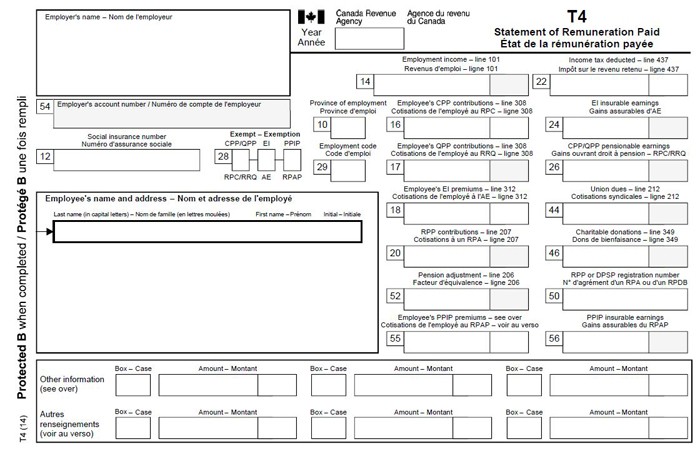

We work with you and the IRS to resolve issues. If you have unfiled tax. They are very helpful and will mail you all of your T4s and any other relevant tax.

Thats because an original return claiming a refund must generally be filed within three years of its due date. The longer you wait to file your taxes the more penalties you will owe and the likelihood of the CRA seeing your avoidance as tax. The BC corporate registry is separate from the Canada Revenue.

Filing taxes late when you dont owe the Canada Revenue Agency any money is still a mistake. The IRS contacting you can be stressful. Self-employed workers have until June 15 2018 to file their tax return.

Havent filed personal or small business T1 corporate income tax T2 or GSTHST returns in several years or more. Individuals who owe taxes for 2017 have to pay by april 30 2018. Get in contact with an accountant who specializes in taxes explain the situation and get your paperwork in.

The IRS estimates that 10 million people fail to file their taxes in any given year. How do I file my taxes for last 3 years. If you havent filed a tax return for tax year 2017 and had any money.

Answer 1 of 24. Section 239 of the Income Tax. Oftentimes people may find that once they.

Yes file your taxes and if you havent filed for a year or twoor morespeak with a tax professional who can help you get it resolved. If you fail to file on time again within a three-year period that penalty goes up to 10 of unpaid taxes plus 2 per month for a maximum of 20 months. Ad Owe Over 10K in Back Taxes.

I havent filed taxes in. If you have any questions about the above information please dont hesitate to call me at 250-381-2400 and I would be glad to help you through the process. You are not the only person to have gone years without submitting.

According to the cra a taxpayer has 10 years from the end of a calendar year to file an income tax return. I didnt file taxes for four years 2011-2014. If you have unfiled tax.

In fact you should even file your taxes if you do not owe any money. Once you file your return the CRA will adjust your tax owing to the actual balance. However if you did owe money there would be interest on it probably jot a big deal.

Tax Relief Help Help With IRS Back Taxes 2022 Top Brands Comparison Online Offers. Filing multiple year tax. Have you been contacted by or acted upon Canada.

The IRS contacting you can be stressful. In Canada any person who has been charged with a late-filing penalty for three tax years will be fined 10 per unpaid balance and 2. Havent Filed Taxes in 3 Years If You Are Due a Refund.

According to Section 238 of the Income Tax Act failing to file your tax return can result in a fine of 1000 25000 and up to one year in prison. Procedure to file Income Tax Return ITR for previous years Income tax return for previous years can be filed through offline and online. The BC Corporate Registry.

You legally have 3 years to file income tax so no problems there - youre not in trouble or anything. Ad Need help with Back Taxes. Helping business owners for over 15 years.

Just all the CRA its fine. Filing your taxes in Canada is a straightforward process that needs to be done every year. Most Canadian income tax and benefit returns must be filed no later than April 30 2018.

Common App Essay Do S Don Ts Infographic Common App Essay College Essay Best Essay Writing Service

Us History Lower Abs Workout Exercise Fitness Tips

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

Tax Deductible Payouts Sheet Reading Log Printable Organizing Paperwork Reading Log

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Vancouver Bc Canada Vintage Packaging Tin Tin Pail

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

How Do I Get My Prior Years T4 And Or Other Tax Slips Taxwatch Canada Llp

Creek Chub Bait Company Indiana Historical Bureau Old Fishing Lures Fishing Bobber Vintage Fishing Lures

Pin By K B On Arbonne Stuff Business Opportunities Quotes Opportunity Quotes Rodan And Fields Consultant

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

The Penalties For Late Tax Filing 2022 Turbotax Canada Tips

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

Trinity Works Entertainment Sigma Films Canadian Film Or Video Production Tax Credit Cptc Creative Scotland Icon Film D Film Distribution Old Movies Movie Tv

Filing Back Taxes And Old Tax Returns In Canada Policyadvisor

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

Missed The May 2nd Tax Deadline It S Not Too Late 2022 Turbotax Canada Tips